Predict the Mutual Funds Most Likely to Outperform Their Peers.

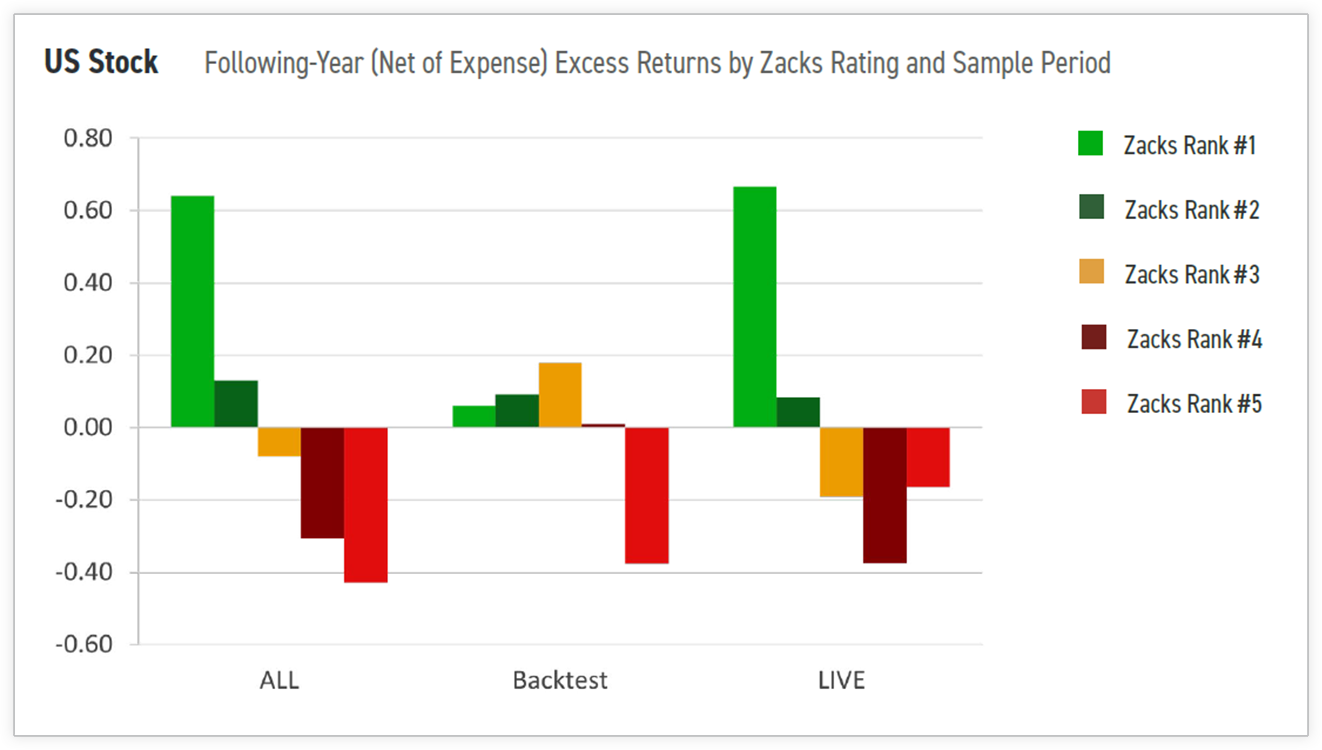

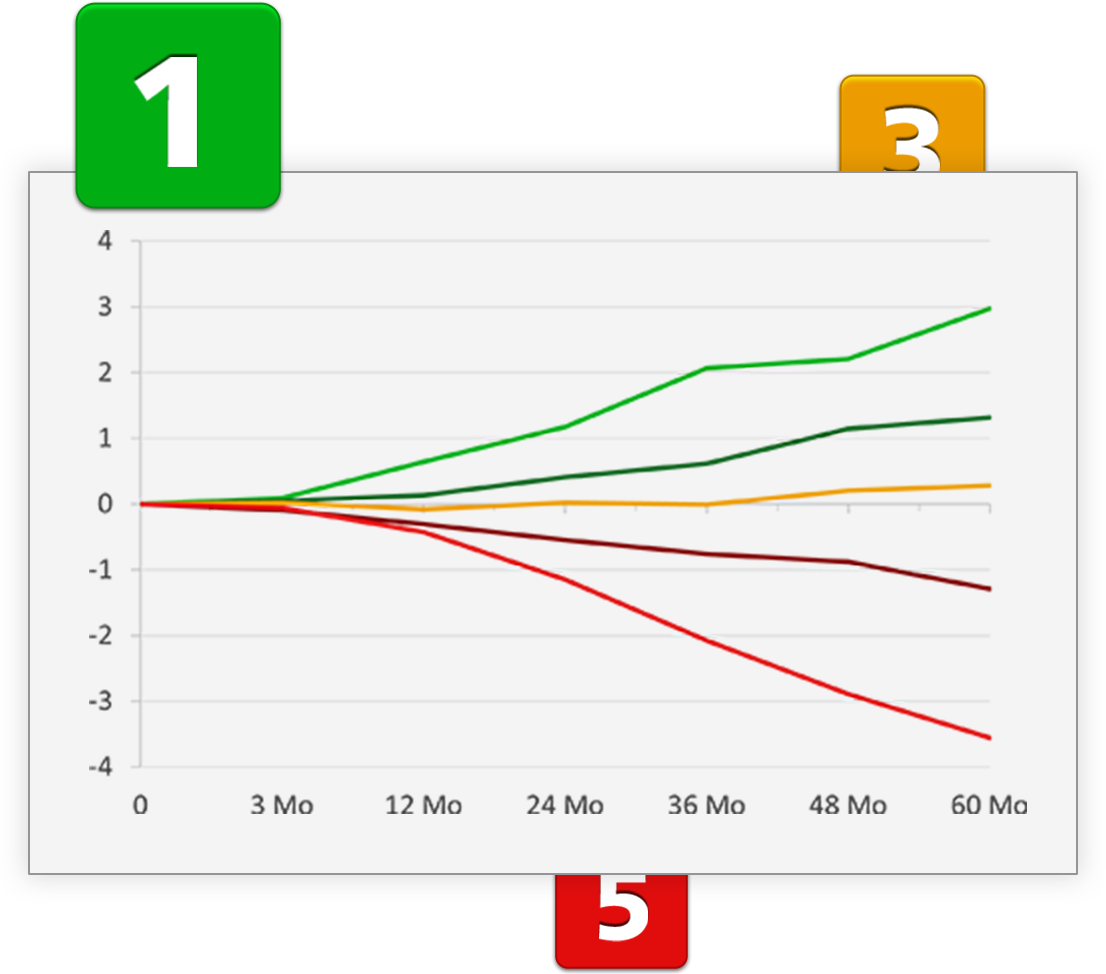

The Zacks Mutual Fund Rank boosts your ability to identify promising funds while weeding out likely underperformers. Unlike other rating systems, Zacks Mutual Fund Rank is predictive. It’s not a scorecard of past performance—it’s a forecast, and it has proven to be extremely accurate.