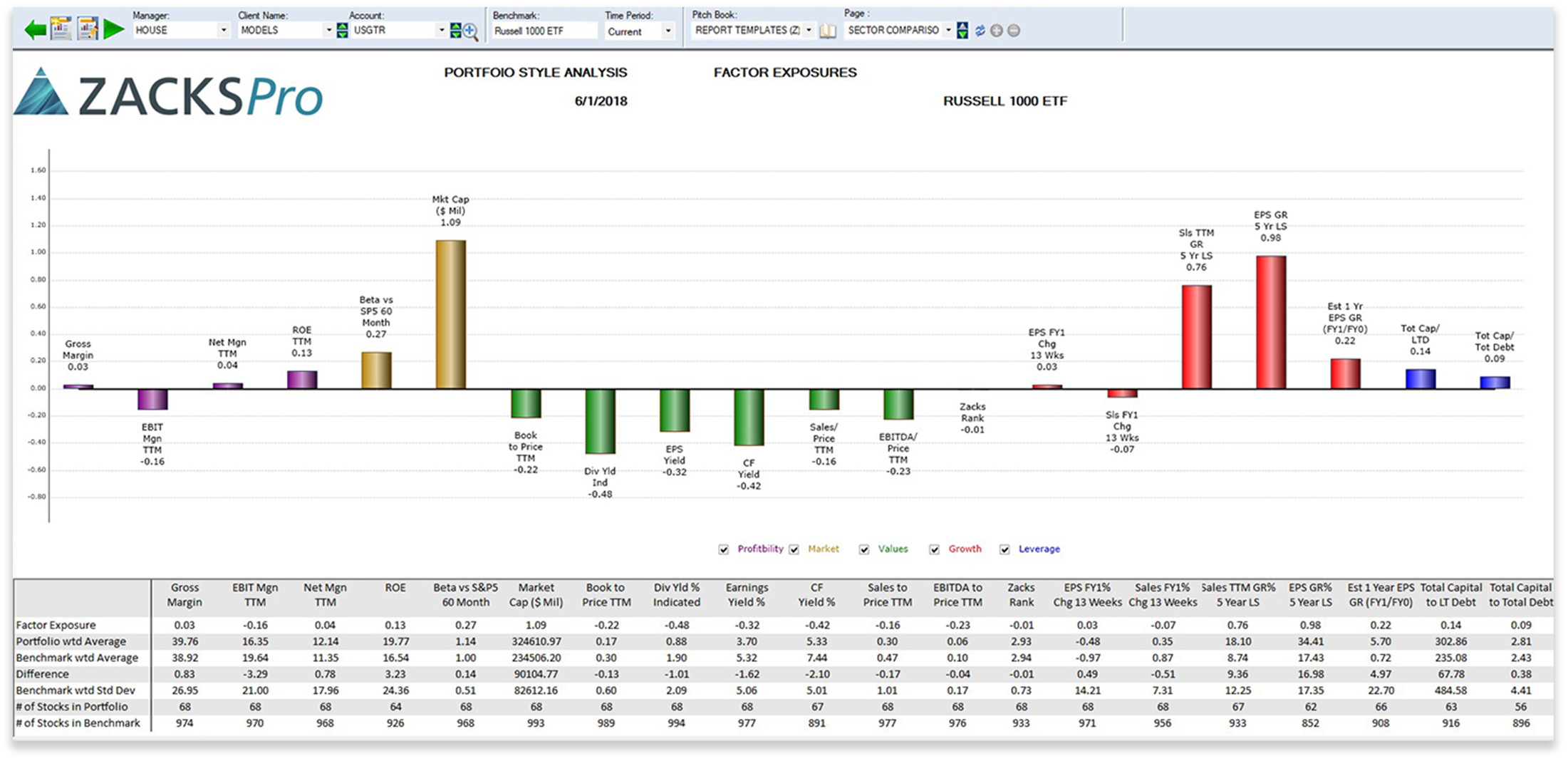

When presenting any portfolio to clients or prospects, it is critical to clearly show how it compares to relevant benchmarks and similar funds.

Zacks Research System’s new Style Analysis tool gives you an easy-to-use way to provide practical style and structure insights into the portfolio makeup.

More importantly, you can use the key investment factors that define the style to accurately compare any portfolio to its benchmarks.

Get a FREE demonstration of Zacks Research System and discover how our Style Analysis tool can work for you.

It helps you answer key questions.

Show the sources of growth potential of your fund over the next year.

Demonstrate the depth of your Value fund compared to others (high EPS/Price).

Define whether your fund is a Large Cap, Mid Cap, SMID, Small Cap, or All Cap fund.

Plus many more

How our Style Analysis tool measures portfolio styles.

We use investment factors to measure styles: Book/Price, ROE, EPS Growth, Sales Growth, Market Cap, Beta and more.

For each investment factor, we look at how much more/less of the factor is in the portfolio compared to the benchmark.

Standardized measurement allows factor exposures to be properly compared to each other and to other portfolios.

Our Style Analysis lets you communicate with clarity and confidence.

Minimizes client misconceptions and defections

Helps satisfy fiduciary

requirements

Properly classifies portfolios when submitting to consultants

Helps secure new business from prospects

Clearly demonstrate your portfolio’s style with Zacks Style Analysis.